Financial strategy

Optimizing corporate capital structure for scalable business growth

Strategic resource allocation drives fiscal stability while mitigating currency volatility risks in complex macroeconomic landscapes.

Debt management

Leveraging secured corporate credit to fuel global expansion operations

Securing commercial lending terms requires audited balance sheets and consistent operating cash flow. Institutions scrutinize leverage ratios before approving revolving lines of credit for operational scaling. Smart borrowers analyze restrictive covenants and repayment flexibility to ensure leveraged capital acts as a growth catalyst rather than a liquidity trap.

Ignite your vision

The top 3 funding engines for SMEs and startups

Maximum Independence: Reinvesting retained earnings and personal savings for fully controlled growth, without debt or equity dilution.

Unlock Capital Quickly: Secure commercial loans from institutions, featuring amortized repayment schedules and competitive APR rates.

Market Validation: Gather equity micro-investments from the public to validate business models and build engagement before market entry.

Asset allocation

Building a resilient and diversified investment portfolio

Public market equity strategies

Investing in blue-chip companies offers liquidity and exposure to macro trends through dividend stock selection and ETF tracking.

Corporate real estate holdings

Industrial property acquisition provides tangible value and lease income streams that hedge against CPI inflationary pressure.

Fixed income securities

Sovereign and corporate bonds serve as stabilizing yield forces within diversified portfolios, offering predictable coupons and lower volatility.

Compliance frameworks

Navigating complex fiscal landscapes and regulatory standards

Adhering to evolving statutory tax codes requires vigilance and audit planning to avoid regulatory penalties. Corporate governance structures must integrate AML checks into transactions, ensuring cross-border operations respect trade treaties and jurisdictional obligations while optimizing the consolidated effective tax rate for the organization.

Digital insurance

The rise of insurtech in modern coverage

Predictive platforms and automated claim systems revolutionize liability management and customer experience. Real-time actuarial analysis enhances underwriting accuracy, while digital portals streamline onboarding. Embracing InsurTech innovations allows insurers to offer usage-based products, faster service, and greater transparency for commercial policyholders worldwide.

Revolutionizing finance with AI-driven accounting

Forecasting algorithms now predict revenue variance with precision by examining historical financial trends. CFOs leverage these predictive tools to anticipate liquidity shifts or operational challenges, enabling swift budget recalibrations. This analytical, data-focused approach converts raw ledgers into strategic insights that drive informed executive decisions.

Executive leadership

Cultivating high performance teams through strategic vision

Transformational leadership transcends task delegation; it involves aligning KPIs with the broader corporate mission. Transparent communication channels foster stakeholder trust and encourage intrapreneurship at every organizational level.

Agile decision making processes

Modern managers must pivot quickly when market conditions shift, empowering scrum teams to execute changes without bureaucratic delays or excessive hierarchy layers.

Talent retention strategies

Investing in upskilling creates a loyal workforce, reducing recruitment costs and ensuring that institutional knowledge remains within the company culture.

Digital revolution

Fintech between security and decentralization: the new pillars of finance!

Financial security (RegTech / Cyber-Fintech)

Digital Shield and Legislation: Using AI to automate fraud monitoring and ensure lightning-fast KYC compliance with minimal human error.

Decentralized finance (DeFi) innovation

Banks Without Intermediaries: Distributed ledgers offer accessible, transparent financial services (lending, staking) managed entirely by smart contracts.

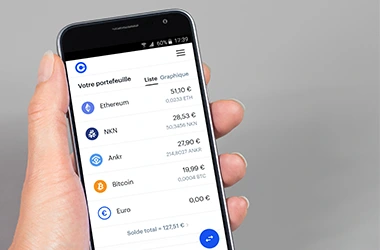

Cryptocurrencies: the essential asset

Digital assets are rapidly transforming global trade and investment, demanding precise and up-to-date custodial risk management strategies.